The mortgage market is fiercely competitive—real-time leads for purchase mortgages typically cost between $40 and $100, and refinance leads range from $35 to $85 depending on exclusivity and targeting. That means every single unqualified lead or slow follow-up chips away at your margins.

If you’re finding it tough to generate qualified mortgage leads, you’re not alone. The long sales cycles, trust barriers, and strict regulations make it one of the hardest consumer verticals to crack—not only do you have to generate interest, but you also need to earn trust fast.

This guide covers what really works today: smart, mortgage-specific tactics, tools built for efficiency, emerging trends, and how automation—like Woodpecker—can make it all more scalable.

What is mortgage lead generation?

Mortgage lead generation is the process of finding new prospects who are actively exploring loan options or researching the mortgage process. For brokers, loan officers, and mortgage lenders, it’s about turning strangers into quality leads who are ready to engage with your mortgage services.

Leads generally fall into two categories:

- Marketing qualified leads (MQLs) show early interest, such as downloading a guide on current rates or engaging with your written content on social media platforms. They’re not ready to apply but are open to learning more.

- Sales qualified leads (SQLs), on the other hand, are closer to taking action—booking a call, requesting mortgage options, or directly contacting a broker.

The mortgage industry comes with three main, unique challenges:

- First, there’s a high trust barrier: many homebuyers want reassurance through reviews, referrals from other real estate professionals, or even social proof from past clients before choosing a lender.

- Second, compliance is strict—every outreach must respect regulations.

- Third, lead generation is often tied to geography. Unlike SaaS, your lead generation efforts must focus on local search results, Google Maps visibility, and connections with financial planners, divorce attorneys, and other loan officers to secure referral business.

Best tactics to generate mortgage leads

Let’s start with one truth: no single tactic works in isolation. The best results come from a smart mix—online, offline, inbound, and outbound. In this section, we dive into one of the most scalable outreach tactics out there: cold email and strategic outreach.

Cold email & outreach

Cold email remains one of the most potent tools for mortgage professionals aiming to scale referral networks or nurture inbound interest. Whether you’re reaching out to real estate agents, financial planners, or past clients, the right approach gives you repeatable, high-margin leads—if executed with precision.

Why personalized outreach wins in mortgage lead gen

Mortgage is a relationship-driven industry. A well-crafted, personal email can open doors and reinforce trust among referral partners. Automated sequences amplify your reach—without sacrificing nuance or warmth.

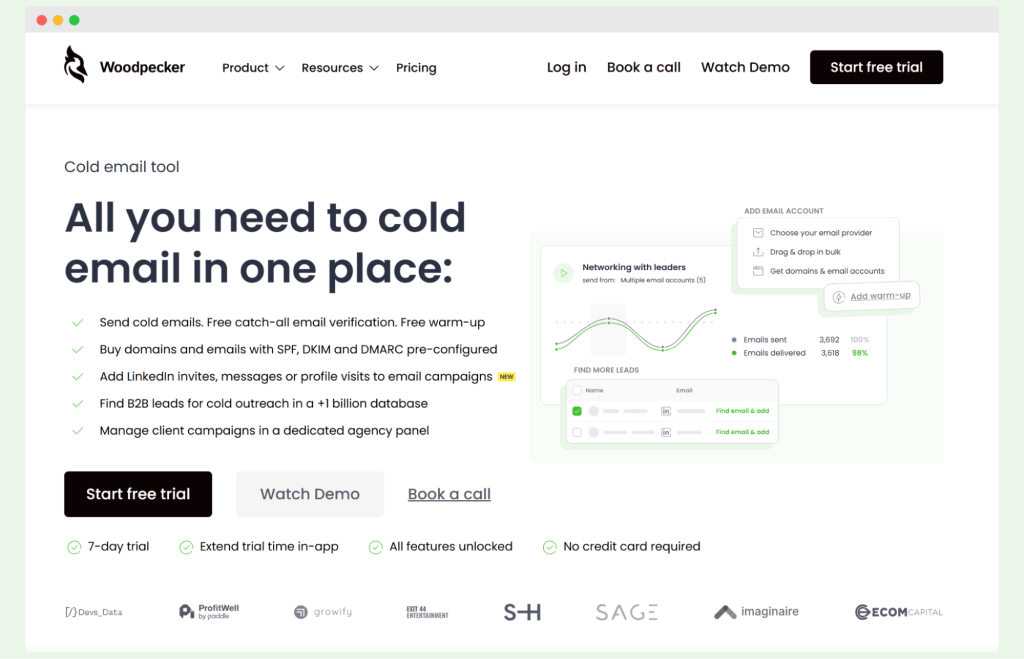

Why Woodpecker stands out

- Condition-based campaigns let you dynamically respond to prospect actions—pause when someone replies, trigger a new path for non-openers, or schedule manual tasks when needed. This ensures every contact receives a relevant follow-up.

- A/B testing across up to 5 variations enables you to experiment with subject lines, opens, or CTAs. This helps you uncover what messaging resonates best—refining your outreach over time.

- Deliverability armor: features like free email warm-up, inbox rotation, adaptive sending, and domain audits (SPF/DKIM) keep your emails landing in inboxes—not spam folders.

- Automated follow-ups keep outreach persistent and relevant. Whether it’s reminding a referral partner about an upcoming rate update or nudging an interested borrower, Woodpecker automates it all.

- Ease and speed: From onboarding to launching your first campaign, the platform guides you through quick setup and intuitive campaign management.

Putting it into motion

Imagine sending custom outreach to local real estate agents offering a co-branded rate update. With Woodpecker, you can automate follow-ups—tracking opens, triggering next steps, and refining subject lines—all while your pipeline grows in the background.

Content marketing and SEO

In the mortgage industry, content isn’t just a way to rank in search results—it’s a way to build trust in a space where compliance limits what you can say on paid ads or even some social media platforms. Strict regulations often mean that bold claims or quick-fix promises get flagged, which is why many mortgage lenders turn to long-form, educational content creation instead of flashy marketing.

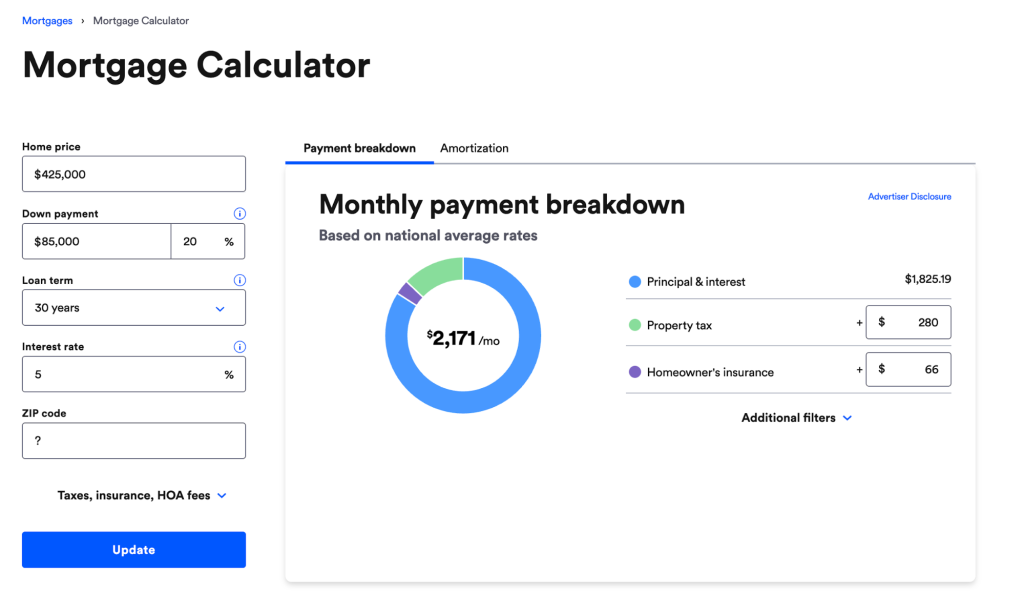

The most effective approach is to publish high quality content that answers real borrower pain points. Mortgage calculators, first-time buyer guides, current rates explainers, or FAQs about various mortgage options all attract new prospects organically.

They also serve as powerful lead magnets—trading valuable tools or resources for an email address, so you can continue the conversation through email marketing or a CRM.

Paired with search engine optimization, this strategy compounds over time. Educational blogs and guides continue to bring new mortgage leads month after month, making content and SEO one of the most sustainable lead generation efforts in a heavily regulated industry.

Referrals & partnerships

Referral partnerships are the lifeblood of mortgage lead generation—transactions flow faster and conversion rates are stronger. In fact, 87% of new mortgage business comes from person-to-person referrals or existing lender relationships.

Referrals earn trust instantly, cutting through the high-trust barrier inherent in mortgages. Partnering with real estate agents, financial advisors, or complementary local businesses gives you direct access to pre-qualified prospects—locked-in social equity, not cold outreach.

Take OneDome in the UK, for instance. Their partnership with Costco enables them to tap into an established membership network, offering integrated mortgages and conveyancing to a highly engaged audience.

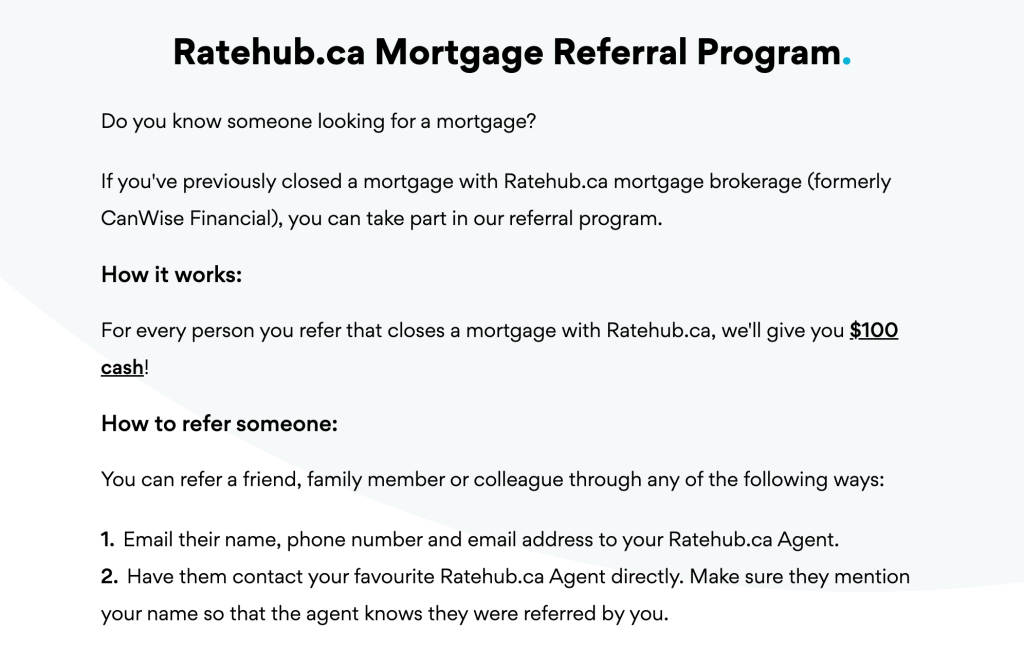

You don’t need to partner with anyone, though. Simply start offering some referrals on your website like Ratehub.ca does:

To replicate this locally, start small: team up with your top-performing realtors or financial planners. Offer lunch-and-learns or co-branded informational flyers. Build referral programs rooted in connection—not commission—and watch how high-converting referral leads outperform paid channels, delivering trust and speed.

Social media marketing

Social media isn’t just for visibility—it’s a high-trust channel for mortgage professionals to educate, connect, and convert, especially where advertising can be tightly regulated.

Paid channels like Facebook and LinkedIn ads allow you to target audiences precisely—by location, demographics, or interests—and promote meaningful content such as rate explainer videos or first-time-buyers guides. Platforms enable tailored messaging that speaks directly to local homebuyers and referral partners.

But the real impact comes from social selling, not just broadcasting updates.

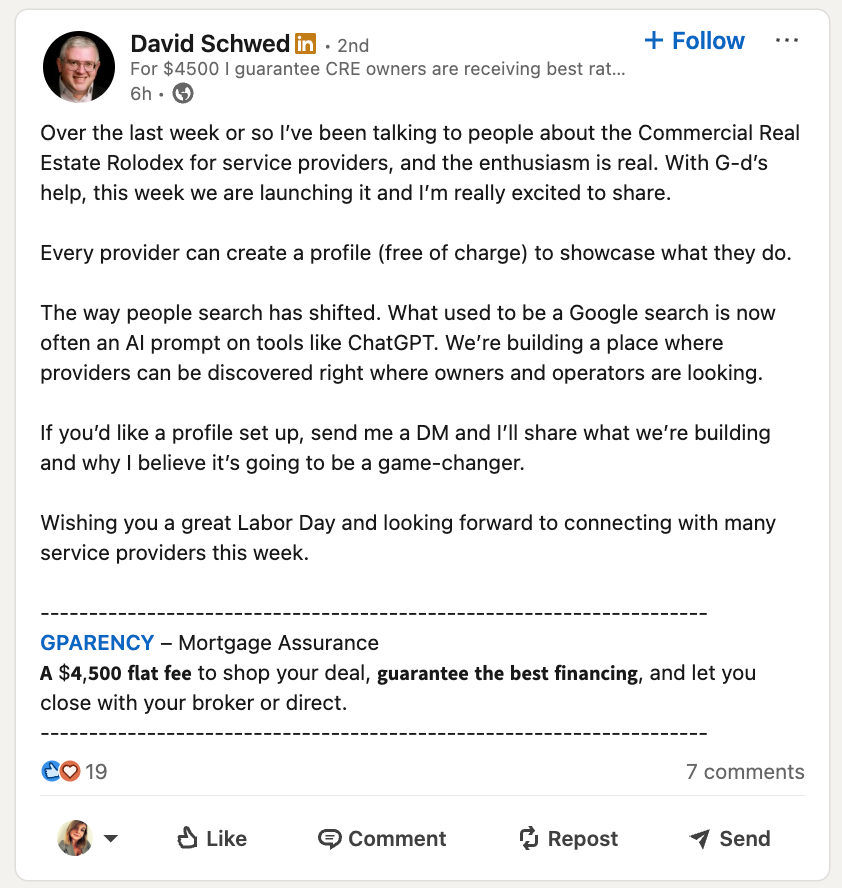

This is where social selling comes in. Instead of generic promotions, loan officers can share practical insights, case studies, or market updates directly on LinkedIn or Facebook, engaging real estate professionals, past clients, and other loan officers.

As David Schwed’s post illustrates, the conversation is shifting: instead of searching Google, many people ask AI tools or look to their networks. If you’re visible in those conversations with useful content, you’re already ahead.

Lead nurturing & follow-ups

Mortgage lead cycles are notoriously long—prospects often need multiple touchpoints before they commit to a loan. Nearly half of businesses say their leads require long-cycle nurturing with multiple influencers involved before converting. That’s why a one-off contact won’t cut it in mortgage marketing.

Automated email flows deliver subtle, persistent value—keeping you top of mind while guiding prospects through rate changes, loan updates, or comparison tools. For example:

- A first-time homebuyer who downloaded a rate guide can receive a follow-up email with a referral to a trusted real estate agent.

- A prospect who inquired about refinancing gets a follow-up with current interest rate analysis and comparison of new leads vs. buying leads.

- A previous lead who didn’t convert receives a gentle reminder about changing loan options or offers to revisit the mortgage process.

This structured approach—via email or even direct mail where allowed—keeps communication consistent, adds real value, and ultimately turns passive interest into new business and high-quality leads.

Local SEO & Google Business Profile

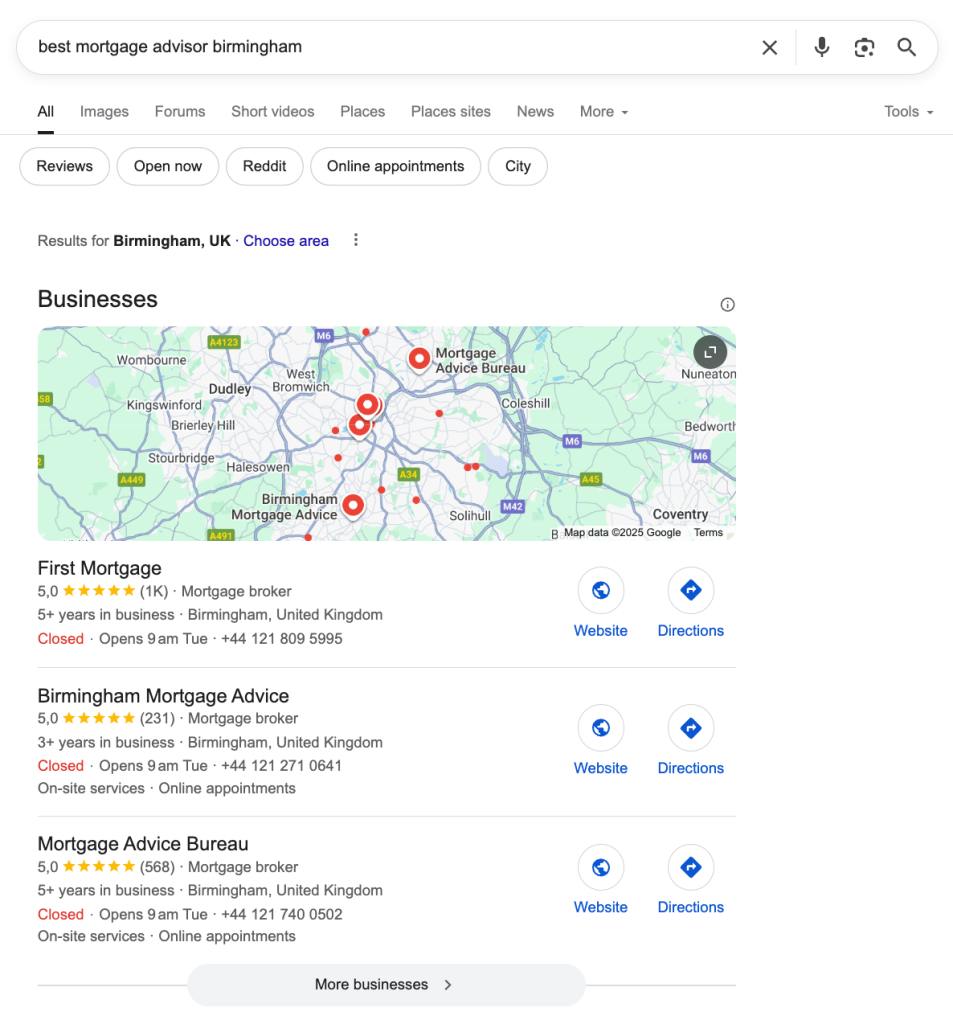

When people look for a mortgage broker, they rarely scroll through pages of search results. Instead, they type something like “best mortgage advisor Birmingham”—and what shows up first is the Google local pack, a map with three highlighted businesses. In the screenshot, brands like First Mortgage, Birmingham Mortgage Advice, and Mortgage Advice Bureau dominate prime real estate before any ads or organic listings even appear.

This is why optimizing your Google Business Profile (formerly Google My Business) is essential for mortgage marketing. Keeping your profile up to date with contact details, opening hours, services, and posts about current rates or loan options ensures you show up when potential customers are searching locally. Reviews from past clients and fresh photos add instant social proof, helping you stand out from competitors.

Local SEO isn’t just about your profile—it ties into Google Maps visibility, customer reviews, and consistent citations across directories. Combined with well-optimized landing pages, a strong Google Business Profile puts you directly in front of high-intent leads—people who are actively searching and ready to talk.

In a business where trust and timing matter, ranking in the local pack can be the difference between generating new business and losing it to the competition.

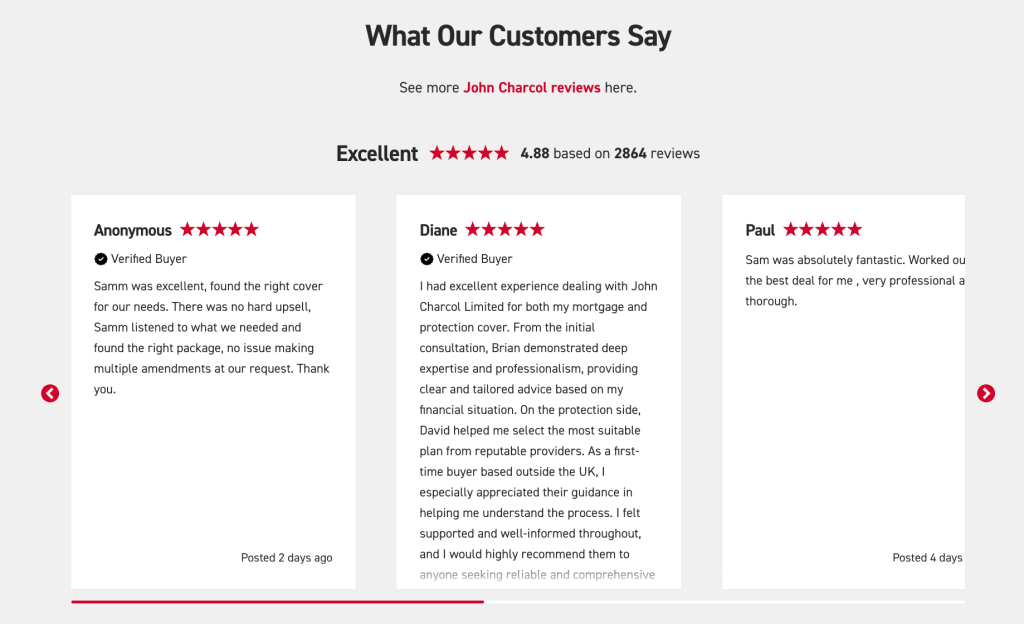

Reviews, testimonials & social proof

In a heavily regulated industry like mortgages, social proof carries more weight than clever marketing copy. Borrowers aren’t just comparing interest rates or loan options—they want reassurance that the process will be handled with professionalism, transparency, and care.

This is why reviews and testimonials are such powerful lead generation tools. A strong review profile on Google, Trustpilot, or industry sites can push you higher in search results, while also converting potential customers who are hesitant to take the next step. In the screenshot, John Charcol highlights over 2,800 verified customer reviews with a 4.88 rating—proof at scale that instantly builds credibility.

Testimonials don’t just attract new leads; they also shorten decision cycles by removing doubts. Sharing detailed case studies, video testimonials, or even screenshots of authentic customer feedback demonstrates real value in ways ads or direct pitches never could.

For mortgage professionals, building a consistent review strategy—asking past clients for feedback, showcasing success stories on your website, and responding to reviews publicly—can be the difference between being one of many companies and becoming the trusted choice for high quality leads.

Events & community marketing

For mortgage professionals, few things build trust faster than showing up where people already gather. Hosting first-time buyer seminars, joining local property fairs, or running Q&A sessions with real estate professionals and financial planners puts you face-to-face with potential customers. These events demonstrate expertise, answer real borrower pain points, and humanize what can feel like a transactional process.

Today, “community marketing” isn’t limited to physical spaces. Many companies now host hybrid events—streaming workshops on Zoom or LinkedIn while also inviting local attendees. A single event can generate new leads for weeks, especially when you repurpose content into blog posts, short clips for social media platforms, or gated replays on landing pages.

Events prove particularly effective for nurturing high quality leads, since attendees have already signaled intent by showing up. For mortgage advisors, this is a cost-effective way to combine education with mortgage marketing, and to stand out as a thought leader in a crowded market.

Third-party lead marketplaces

Many mortgage professionals turn to third‑party marketplaces like LendingTree, Bankrate, and Zillow to quickly access new prospects. These platforms can deliver a steady stream of new mortgage leads, making them attractive for those looking to scale efficiently.

However, there are important trade-offs to consider. For instance, LendingTree predominantly offers shared leads, meaning multiple lenders might receive the same contact—competition that can drive costs and lower conversion rates.

Zillow’s leads are similarly shared and priced between $75–$120 each, though they can go as high as $300+ depending on loan size and exclusivity, which also impacts ROI.

To get the most value, treat these marketplaces as a supplement—not the core—of your lead generation efforts. Plug incoming leads into a CRM, score them, and nurture them through personalized email marketing sequences. The quicker and more relevant your follow-up, the better your chances of converting even shared leads into high quality leads.

Over to you

In the mortgage industry, no single tactic guarantees success. The most effective strategies balance education, referrals, local visibility, and technology. While a lead generation company or Google Ads campaign might give you quick wins, sustainable growth comes from consistently generating leads through multiple channels and nurturing them with care.

The real difference is in how you manage and measure your efforts. With many CRM platforms available—and integrations that connect directly to tools like Google Analytics—you can track every touchpoint and refine campaigns over time. Whether you rely on events, content, or automation, the key is using the right mix of tactics and CRM platforms to turn first conversations into lasting client relationships.

And Woodpecker is here to help. Sign up today and see how you can level up your mortgage lead generation today!

FAQ

1. What is the most effective approach for generating leads in the mortgage industry?

The most effective way to generate leads is through a multi-channel approach—combining referrals, content, and digital outreach. Cold email, social selling, and local SEO deliver scale, while in-person events and partnerships build trust.

2. How can I improve my lead generation efforts as a mortgage professional?

Focus on consistency. Automate follow-ups, optimize landing pages, and track campaigns in a CRM. Testing subject lines, ad creatives, or targeting regularly will help you refine your approach and increase conversions.

3. Does direct mail still work for mortgage lead generation?

Yes. While digital dominates, direct mail remains effective for refinancing offers or targeting specific neighborhoods. Personalized mailers with QR codes linking to calculators or guides can bridge offline and online touchpoints.

4. Why should mortgage brokers work with financial planners?

Financial planners already have trusted relationships with clients making big financial decisions. Partnerships create warm referrals, leading to higher conversion rates and shorter sales cycles compared to cold outreach.

5. How can I use Google Analytics to measure mortgage lead performance?

With Google Analytics, you can track which landing pages generate the most form submissions, monitor ad ROI, and see how users move through your funnel. Pairing this with a CRM helps connect web activity to actual deals.

6. Can divorce attorneys really help with mortgage lead generation?

Yes. Divorce attorneys often work with clients who need refinancing or new home loans. Building partnerships with them can create a steady referral pipeline for high-intent leads.

7. Why is email marketing still important in mortgage lead generation?

Email marketing is one of the most cost-effective tools for nurturing long-cycle mortgage leads. Automated sequences keep you top-of-mind, share updates on interest rates, and deliver ongoing value until prospects are ready to commit.