At the beginning of 2016, I wrote about the Ideal Customer Profile (ICP) framework that we adopted at Woodpecker and about the way we worked on our marketing personas. At that point, we had around 100 B2B customers.

Our customer base has grown to 1000 since then. And it has obviously changed a bit, too. Here’s about how we actually measure the changes in our customer base in order to constantly rework our ideal customer profile as our company grows, and why it’s important to keep the ICP up to date in general.

I’m going to describe in short, step by step, how we analyze our prospect base and how it helps us draw conclusions about our ICP hypotheses. You may treat it as a kind of a case study.

How we find out who our trial and premium users are

Actually, our process of data collection has been manual to a great extent. But this actually allowed us to discover what kind of companies use Woodpecker and which of those companies show the greatest level of success potential.

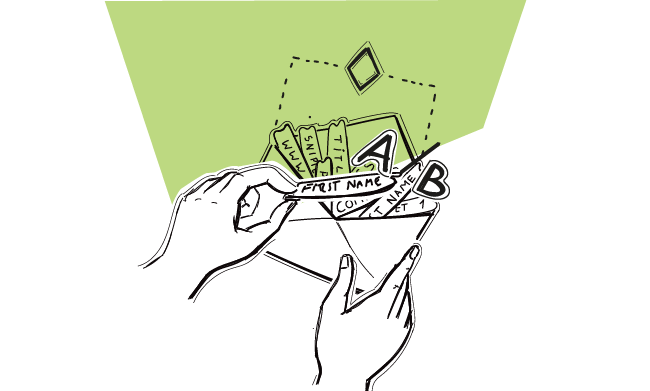

First of all, a few of our team members check out every company that has signed up for the free trial at Woodpecker. They collect some basic information about each company, including:

- the name of the company;

- the company’s website;

- the size of the company (the number of employees);

- the country they’re located in;

- the info about what the company is selling: product/service/product & service;

- the info about the industry the company operates in, for instance: SaaS, software house, consulting business, lead gen agency, etc. (the important thing here is to reduce the number of categories, as much as possible, because too many categories will make the further analysis more difficult and the results less clear).

Each company who starts a free trial of our tool gets a profile in Pipedrive, which has to be filled out.

In a perfect scenario, you hire a person who handles the research process. But depending on the number of trial signups you get, and the size of your sales team, also sales people or SDRs can handle that. Currently, each of our sales team members fills out the information about the company they were assigned to take care of.

Next, also in Pipedrive, each user is marked with a status: trial, premium, churned, as well as the date on which the status has changed.

So after some time, we are able to tell that company X has been using Woodpecker‘s free trial for 8 days before they decided to enroll in a premium subscription, and that they have been a premium user for 9 months before they decided to cancel their account.

How we analyze the customer data

As soon as we have the data collected, we can aggregate it to prepare some reports: weekly, monthly, quarterly, etc. The reports allow us to observe:

- what type of companies convert to premium users most often,

- what revenue each of the types generates on average,

- and, what I think is the most important for us as SaaS, how long they stay with us on average.

And that’s how we can validate, or invalidate, the hypotheses we’ve had about our ideal customer profile.

In SaaS, you’re able to actually tell if a customer is an ideal customer only after a few months. You can’t just close a deal and pop up the campaign.

You’re actually closing the same deal every month. Perhaps your sales team is more engaged in the process before the first payment. But it’s also your customer success team, your product team, your marketing team – and actually all the people you have in there, to keep the customer happy and help them reach their goals month after month.

If you don’t understand that, and if you don’t act upon that – churn will slowly, yet efficiently, kill your business.

Therefore, it’s crucial to try to understand your users’ business characteristics, observe their activity from the very beginning, and keep tracking that over time. Only that allows you to draw conlusions over time and update your ICP hypotheses.

How does data help us rework our ICP

Only by regular and consistent data collection and analysis are we able to draw conclusions about our ICP and we can revise it as our business grows and changes.

Some types of companies we thought would be a perfect fit for our customers a year ago, didn’t really meet our expectations in this respect. On the other hand, there a few types of businesses which we weren’t even mentioning in our ICP discussions, and yet they suddenly showed up and turned out to be great candidates for ideal customers.

But we wouldn’t be able to notice that if we hadn’t been collecting all the data and analyzing our user base. Thanks to the analysis, we can keep our ICP up to date and plan our marketing and sales activities focusing on the users who match our ideal customer profile the best.

A step further: how we get to know our customers

But the quantitative data is not all we pay attention to. Actually, we are currently running a series of customer interviews to actually get to know the people who work at the companies matching our ICP. We ask them a series of questions about their business characteristics, about their goals, as well as about their interaction with Woodpecker.

I will write about the whole process as soon as we finalize the first series of the interviews and we have our first findings, so stay tuned if you’re up for more details.

What’s in it for you?

Just a few questions to ask yourself. Check if you can answer them.

Do you know:

- What are the companies using your product or service?

- What’s their size?

- Where are they located?

- What kind of industry do they operate in?

- What type of business they run? And what are their business‘ characteristics?

- Who are their customers?

- How long do different types of your customers use your product or service on average?

- What are they trying to achieve with your product or service?

- And finally, which of those companies would you assess as having the most success potential?

Start from those 9. I think it’s a lot to find out, anyway, but you can definitely think about other information you would like to discover about your users or clients.

The more you know about your present customers, the better you’ll be able to choose the new ones.

All this will be a tremendous hint for your prospecting processes, whether inbound or outbound.

How to use it in practice?

So, let’s say you’re planning your new cold email campaign. You’re thinking about who your next prospect group should be. Before you start thinking about new directions for your outbound, take a look at your present customers. Choose the best ones. Then analyze them, and look for companies that look alike.

Or if you’re wondering what you should put into your cold email: talk to your best customers, let them describe the benefits they get from your solution, let them think about the times before they were your customers. Ask them about the business problems that your solution helped them solve. Then use the very same pains and benefits in your emails.

Yes, it takes time. Yes, it won’t be easy for your to plan and execute.

But if you ignore that, you’re missing a huge opportunity – to be able to get new customers who match your ideal customer profile.

Hope it helps.

And if you’re targeting enterprise leads, go to this blog post:

How to Land Enterprise Leads by Cold Emailing: ICP Tricks for Great Personalization>>

READ ALSO

Who Are Really My Prospects? – Our Way for Persona Development

Do you know who your prospects are as people? What do they like? What do they care about? What are the things that they can’t stand? What are their personal and business goals? Here’s how we've found specific answers to all those questions for our business, and why finding those answers is so important for the success of your company.

15+ Places Where You Can Find B2B Leads, Other than LinkedIn

If someone made a list of the "most commonly used sources of b2b leads", LinkedIn would be undisputable #1 on that list. And that's understandable. LinkedIn is a mine of information about businesses and people connected with those businesses. But there are also other platforms including collections of companies, divided into categories, where you can find ideal prospects along with some reference points for your cold email campaigns. Here are 15 places on the web where you can find SaaS companies, startups, software houses, marketing experts and other companies that will match your Ideal Customer Profile.

What Does “Ideal” Really Mean in the Ideal Customer Profile?

We treat ICP (ideal customer profile) seriously at Woodpecker. We constantly work on the profile and try to keep it updated. That's not an easy task, because the profile evolves as the company grows and the business situation changes. Our Customer Success Team runs regular meetings concerning ICP. On one of those meetings, we realized that the "ideal" may actually be a set of various traits, depending on the point of view. See what we've figured out in terms of defining our ideal customer profile.