It’s no secret that outbound sales are a numbers game. Prospecting tactics and strategies are important, but not setting clear and achievable sales targets is like jumping in a taxi with no destination in mind; it’s not so smart and it’s simply a waste of money.

Today on our blog, we give the stage to Thibaut Souyris, the CEO and Founder of SalesLabs, who will tell you how to set your sales goals so they’re ambitious, but achievable.

Why is it important to set sales targets for an outbound sales team

If you’ve been in sales for a while, you know that this job is mostly about numbers. From sales targets to commissions, every successful sales organization relies on a set of metrics and specific targets for each one of them. In an outbound sales organization, setting sales targets is crucial as it gives a clear definition of success or failure. If you miss it, you failed, if you reached it, you succeeded. Below is my approach to setting clear, achievable sales targets for an outbound team.

Step 1: Clarify your end goal

When I work with customers, I always ask the following question: “How much do you need to close this year?” And surprisingly enough, most sales leaders or individual contributors come up with a different number. What’s the reason? Well, the metrics that matter to each individual are often different. Here’s an explanation.

Booking, ARR, MRR, Revenue; which one should you pick?

The first thing to clarify is the actual company target. Revenue targets are defined at the top of the organization. Shareholders define them yearly, typically based on historical data. These targets represent the expected recognized revenue for the organization on a clear time-period.

Once the revenue target is identified, it is passed to the VP/Head of Sales. That’s where it needs to be converted into bookings, Annual Recurring Revenue, or Monthly Recurring Revenue.

Bookings represent the total contract value. They are not always equal to revenues. For example, if you close a €100.000 contract in December 2020, but this contract starts in February 2021 of the following year, no revenue will be recognized before 2021.

Monthly Recurring Revenue is a metric measuring an income a business can count on receiving every single month. If you close a €100 monthly subscription, you add €100 of MRR.

Annual Recurring Revenue is a metric measuring an income a business can count on receiving every single year. It’s often calculated by multiplying MRR by 12.

Now that you know what all these terms mean, which one should you choose?

If you’re selling a subscription (typically seen in SaaS), I recommend setting targets in MRR. You will then have a clear understanding of the revenue you add (or remove) every month. If you’re trying to lock customers in multi-year contracts, then ARR makes a lot of sense.

Bookings should be used when you’re selling project-based contracts or deals without recurring aspects. Finally, revenues should be used if your reps are responsible for collections (which I recommend not doing).

How do you generate opportunities?

A second important point is to list the channels used to generate opportunities. Most organizations rely on a mix, using inbound marketing, outbound sales, and referral, to name a few. Below is a list of typical channels used to generate opportunities:

- Outbound – Any opportunity coming from a proactive prospecting effort. Typically using cold calling, cold emailing, and social selling to contact prospects who didn’t solicit a service.

- Inbound – Any opportunity coming from a marketing effort (excluding events). Inbound leads are often driven by SEO, content marketing, paid advertising, to name a few.

- Referral – Any opportunity coming from customers, prospects, vendors.

- Events – Any opportunity coming from in-person events or webinars.

- Partnerships – Any opportunity coming from a formalized business partnership.

In our case, outbound will be the main driver of opportunities. This is the case for sales organizations where marketing doesn’t provide enough leads to reach sales targets. Very often, VC-backed B2B startups use outbound as their main sources of opportunities, as it’s one of the fastest ways to generate quality opportunities. Outbound is also a great way to go upmarket and generate Enterprise deals.

Step 2: Identify your sales process stages and conversion rates

Now that we have a better idea of our targets and the way we generate opportunities, we can start defining our sales process stages and the conversion between each stage.

>> Download my Sales Process Calculator here <<

What are the stages of your sales process?

According to Hubspot, a sales process or sales funnel is a repeatable set of steps a sales team takes to move a prospect from an early-stage lead to a closed customer. I recommend having a clear understanding of your buyer’s journey before building your sales process.

Below are typical stages I recommend when selling a B2B solution:

- Discovery – An initial conversation to find out if a prospect has a problem you can solve. Its goal is to qualify (or disqualify) a prospect, to make sure you are not wasting your time with tire-kickers or people who have no intention to purchase your services.

- Usecase demo – A second call/meeting to build solutions to the problems you have found during the discovery. If you’re selling services, it’s often called a workshop or scoping.

- Proposal/Contract Review – A third call/meeting to present contractual terms and price, once a solution has been found to solve a prospect’s problem.

- Negotiation – A phase in which both parties are trying to solve two different sides of the same problem. Note that negotiation is an ongoing process, but it’s often performed once a price has been quoted.

- Closed Won – A contract has been signed.

- Closed Lost – No deal has been signed. In outbound sales organizations, most deals end in this stage, with many different reasons (lost against a competitor, status quo, no commitment from the prospect, and many other reasons).

Each stage has to have a defined outcome. For example, a deal can go from discovery to usecase demo, only if a second meeting has been agreed between the buyer and the seller. The bigger your team, the clearer each stage has to be.

What are the conversion rates between each stage?

Once your stages are clear, you can start defining the conversion between each one of them. The conversions vary, based on your industry, your capacity to qualify, and the skills of your sales team. Below are some typical rates:

- Disco to demo – With outbound, a standard rate is between 40% and 60%. Anything above 60% and you’re most likely too generous with your time (you don’t qualify properly). Anything under 40% and you’re too selective, or not talking to prospects who have a problem you can solve.

- Demo to review – A 60% rate is standard

- Review to negotiation – A 70% is standard

- Negotiation to closed-won – Between 60% and 80%. When reaching the negotiation stage, most deals can go through. They all depend on your capacity to run a proper negotiation and be flexible on price and terms.

Step 3: Understand your metrics

We are starting to have a bit more clarity on our sales process stages and conversion rates. Now let’s define our average deal size, as well as our sales cycle length.

What’s your average deal size?

Your average deal size is the sum of your closed-won deals over a specific period, divided by the number of closed deals. If you’ve closed 10 deals for a €250.000 worth, your average deal size is €25.000.

Note that you can use your full pipeline, divided by the numbers of deals in the pipeline if you don’t have enough data on closed deals. But be careful, it’s not because a deal is included in your pipeline that you will necessarily close it. With outbound, a good win rate is between 20% and 30%.

What’s your average sales cycle length?

On top of your average deal size, your average sales cycle length is also an important metric to watch. To find it, add the total of days required to close all your deals, and divide it by the number of closed deals.

This metric will help you find out how realistic your sales targets are. For example, if your average sales cycle length is 90 days, you should start each quarter with a full pipeline, as each deal takes 90 days to close (on average).

Step 4: Clean up your pipeline

When I was working at a mobile measurement tech startup, one of my colleagues was the king of unrealistic expectations. He was missing each quarter by a large amount, even though he had the biggest pipeline of the EMEA team.

Cleaning up your pipeline is an essential step to take before starting your calculations. Here’s a simple framework to keep or kill your deals.

If your deals have no clear next steps, close them lost. The next step is either a planned call/meeting or a follow-up. Remember, having closed lost a deal doesn’t mean you won’t be able to create a new opportunity later. It simply means that you don’t have a valid opportunity at the moment.

Step 5: Calculate your target

We’re finally ready to calculate our target and find out if it’s achievable. If you didn’t download my sales target calculator, do it here.

Start by setting your booking, MRR, or ARR target. Once done, divide it by your average deal size. This will give you the number of deals to close in the period you’ve chosen (monthly, quarterly, yearly).

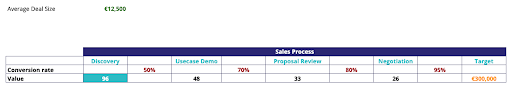

Now divide this value by the negotiation to closed-won rate. This will give you the number of deals that have to go through the negotiation stage. Divide this value by the contract/proposal review to the negotiation rate. Do so until you reach the number of deals that have to go through discovery, assuming your pre-existing pipeline is empty. Below is an example.

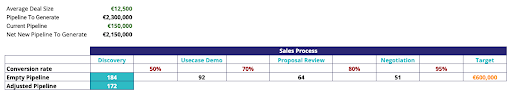

In our example, we need to generate 96 discovery calls. Now multiply that number by your average deal size. You will find out the total pipeline value you need to generate to reach your target. Take your existing pipeline value and deduct it from the pipeline to generate. Finally, divide that number by your average deal size and you will find how many discoveries have to be performed.

See the example below.

Finally, use your average sales cycle length to find out if your targets are realistic. If your current pipeline is empty and your average sales cycle length is above your measurement period (monthly, quarterly), it’s going to be challenging to reach your targets. If the average sales cycle length is below the measurement period, you’ll have more chances of making it to the end.

Step 6: Communicate your target and commit to it

We’re finally done. We have a precise end goal, we know the stages of our sales process and the conversion rates, and we have a clear understanding of our important metrics. On top of that, we have a clean pipeline and we know if our targets are achievable. The last thing to do is to enforce our targets and track progress.

Communicate and enforce targets

Your reps are ready to start building pipeline and closing deals. Make sure they have a clear number to reach. This is done with a compensation plan, which is agreed on at the beginning of a period (typically a year) and when a new rep starts.

Be sure that your reps understand what they have to achieve and have a clear understanding of the steps required to do so. Do they know if they have to prospect, or do they think they will receive enough from marketing and the SDR team? This is your responsibility to have them build a plan.

Get commitment and track progress

Have regular sales meetings and 1:1s with your reps to share the achievements of the sales organization (done in sales meetings), and adjust any bad performance (done in 1:1s). I suggest using a dashboard and sharing weekly results in a sales meeting.

If you follow these steps, you should be able to set clear sales targets, adjust them so they are realistic, and have a high-level idea of your plan to reach them.

FAQ

What are your sales targets?

Sales targets are specific goals set for the sales team to achieve within a defined period, such as quarterly sales volume or the company’s annual revenue target.

How do you calculate sales targets?

Sales targets are calculated by analyzing past performance, considering market conditions, and aligning with the overall sales strategy to set realistic sales targets that challenge and motivate the sales force.

How do you find sales targets?

Finding sales targets involves assessing the potential of different markets or segments, evaluating sales metrics, and determining achievable objectives based on the sales team’s capacity and sales strategy.

What is a sales target level?

A sales target level is a specific milestone that sales reps strive to reach, typically quantified by metrics like the number of units sold or revenue generated, integral to measuring sales performance.

What is a sales target example?

An example of a sales target could be increasing customer acquisition by 20% or boosting the sales team’s quarterly revenue by 15% compared to the previous period.

What are sales objectives and targets?

Sales objectives and targets are benchmarks set by sales managers to guide the sales teams toward achieving broader business goals, including short-term sales goals and strategic sales team strategies for long-term growth.

How do you set a good sales target?

To set a good sales target, sales leaders should consider factors like market potential, past sales performance, and the growth trajectory of the business. Targets should be challenging yet achievable to motivate sales reps effectively.

How do you achieve sales targets and KPIs?

Achieving sales targets and KPIs requires a coordinated effort from the sales teams, involving diligent tracking of sales activities, regular reviews of progress against goals, and strategic adjustments to the sales approach as needed.

READ ALSO

5 Tips for Effective Sales Prospecting in 2020

Looking for ideas to level up your prospecting game in 2020? Here you are -- I put together a list of 5 sales prospecting tips worth implementing into your lead generation strategy this year and onwards since I believe they are pretty much everlasting. Get yourself a nice cup of coffee and read on.

6 Top Sales & Business Podcasts that You Should Listen to in 2020

Where do you get first-hand knowledge on sales and growing a business? Blogs, YouTube and various courses are probably the Top 3. And how about podcasts? They’ve gained huge popularity these years. No wonder, you can drive your car or train at the gym and learn new things at the same time. I asked Vovik, the Head of Inbound Sales at Woodpecker, and Yuri, the Head of Outbound Sales, to recommend the examples of their favorite sales & business-related podcasts. Here’s the list.

15 Best Subject Line Examples We’ve Come Across (Updated)

We always say that a cold email subject line is like a key to a door. Today, I present to you examples of attention-grabbing subject lines that will work like the right key to the right door and open up a conversation with your prospect. We analyzed the best sales email subject lines at Woodpecker and uncovered a really interesting thing that may help you. Keep on reading to find out what it is.