If you sell insurance, then you’ll agree there’s nothing worse than dealing with sales objections that stop you from writing a new policy.

If you want to overcome sales objections, then you’ve found the right article.

Today, David Duford, the owner of BuyLifeInsuranceForBurial.com and the author of three best-selling insurance sales books, enters the Woodpecker blog to detail his word-for-word rebuttal scripts to defeat the top 10 most common insurance sales objections.

Let’s get started and focus on overcoming sales objections!

#1 Objection: “I’m not interested.”

When someone says “they’re not interested,” it’s usually early in the sales process.

I call this a knee jerk objection. Do not take it seriously. Plus, how can they know they’re not interested before you’ve explained how your product works?

Here’s how you handle it:

“That’s fine, Mrs. Prospect. Many people say they’re not interested, but the reason they meet with us anyway is that our programs are completely different from what you’ve seen. All I need is five minutes to show you how this works, and what you do with the information is up to you. Can I see you tomorrow at 2:00, or would 10:00 work better?”

Why does this script work?

First, it mentions that others felt the same but still agreed to meet you. This gives the client a reason to meet despite their initial resistance.

Then, we focus on how quick the appointment is, emphasizing the meeting is low stress and no pressure whatsoever.

Finally, we close with a yes-yes question, “What time works best?” Try to avoid asking a yes-no question, “Can you meet tomorrow?”

You’ll find that the process is similar for some objections, so be sure to refer back for more context. And don’t forget to address your client appropriately at the start of every rebuttal: I understand, Mr/Mrs. Prospect. That’s fine…

#2 Objection: “Mail Me Information”

Just like the objection above, you’ll hear this either in person or over the phone, and you can handle it the same way.

“…All I need is five minutes to show you how this works, and what you do with the information is up to you. Can I see you at 10:00 or 2:00?”

#3 Objection: “I Already Have Life Insurance”

Here’s another knee jerk objection. Again, try to handle it just like the first two.

“…All I need is five minutes to show you how ours is different. What you do with this information is up to you. Can I see you at 10:00 or 2:00?”

#4 Objection: “It’s Too Expensive”

You’ll experience this objection near the end or early on if you’re pre-qualifying your client, and they’re on a budget.

Tackle this by finding out your client’s budget ASAP and match your offer to suit. Typically when customers complain about the price because YOU failed to build value.

If they still object even after you’ve built value and matched their budget, here’s what you should do:

“…We hear this often. But you said that you need insurance. And at the end of the day, what’s going to cost more? Paying the premium or avoiding insurance and ending up in desperate need of coverage due to a sudden, freak accident. You won’t solve this problem by not getting insurance. You’ll only make the issue much worse. Why don’t we start with this plan? Or would you prefer to see a lower quote?”

#5 Objection – Let Me Think About It

You’ll often hear this at the end of a call. In the business, we call this a “smokescreen objection.” Simply put, it’s an excuse – a polite way to avoid explaining the real issue. To tackle this, you must unearth what the actual problem is.

When a potential client says, “Let me think about it.” You say, “…When you say you need to think about it, what do you mean?”

The prospect answers, you reply with, “Okay. Beyond X, is there any other reason you wouldn’t do business today..? And if I can help you solve X, is there any reason why you wouldn’t move forward with this plan?”

By doing this, you isolate the objection, confirm there are no other issues, and then secure a commitment to move forwards. Just like overcoming objections is critical in sales, having accurate, real-time information is vital in emergency services. That’s why many agencies use emergency dispatch software for call routing and EMS reporting software to streamline incident tracking, compliance, and performance monitoring — ensuring better decision-making under pressure.

#6 Objection – Let Me Talk To My Kids

Another smokescreen objection that’s commonly heard at the end of the call.

If you come across this a lot during pitches, you should focus on building rapport early on and gaining your client’s trust.

When somebody wants to confirm the plan with their kids, especially seniors, it usually means you haven’t earned their trust. Here’s what I recommend you say next:

“…I understand why you would want to discuss this with your children, but you said you need coverage NOW. If something bad happens between now and sorting this out, your kids will have to cover the funeral costs. Most parents I talk to want to avoid this from ever happening. You probably feel the same since it shouldn’t be their responsibility.

Look, Mrs. Jones. You’re a person wise enough to make your own decisions. And I think we would both agree that the sooner you sort this out, the better. Let’s go ahead and start you on a plan today. Who do you want your beneficiary to be?”

#7 Objection – Let Me Talk To My Lawyer Or Accountant

You’ll hear this mostly with business owners. The trick here is to agree that it’s important to find out what their lawyer or accountant has to say.

Famous insurance salespeople like Ben Feldman and Frank Betcher use these strategies to move the ball forward and secure an application.

Try this approach:

“…Why don’t we do this? I also think it’s important that you talk to your accountant or lawyer and provide them with accurate information so they can help you make the right decision. In the meantime, what we have here is simply a proposal.

At this time, I can’t even guarantee that you’ll qualify until we complete the process. Here’s my proposition. I don’t need any money from you today. And if you decide not to go ahead, that’s fine. But if you’re serious about getting insurance and honestly want an accurate opinion from your accountant or lawyer, we must qualify you first.

We’ll send somebody out to you. Free of charge. And work around your schedule. So let’s get that done first. Then you’ll have all the information and can get an honest, informed opinion from your accountant or lawyer. Otherwise, you won’t be able to provide them with all the facts. So, how do you feel about moving forward?

#8 Objection – I Don’t Believe In Insurance

This one’s a bit more challenging. The best course of action here is to assume they don’t understand how insurance works.

Chances are they have a good reason behind this objection. Perhaps a friend or relative got short-changed by an insurance company in the past.

When you’re setting the appointment either face-to-face or over the phone if you hear this, here’s what you should do:

“…A lot of people say this. But just give me five minutes to show you how my insurance is different. What you do with this information is up to you. Does 2:00 or 4:00 work best for you for a meeting?”

#9 Objection – I Like It But I Don’t Want to Buy It Now

Some prospects will claim that they’re interested but not ready to commit. The issue here is “urgency.” Most likely, you didn’t build enough value or explain the importance of having insurance.

We commonly advise life insurance agents to tell the client to picture the hearse backed up against the front porch. It sounds a bit extreme, but to benefit from life insurance, you have to… well, die. And people are understandably afraid to imagine this.

To overcome this resistance, try this:

“…But in reality, no one can promise you tomorrow. You and I both know that bad things can happen with no warning. And even if you’re lucky and just get injured or ill, that can still affect your ability to get coverage. You might not qualify for this plan later on.

And, you won’t fix this issue by avoiding the problem. The solution is to get started with a plan sooner rather than later. Let’s go ahead and take this plan out, start it next month, and then you can relax. Who do you want your beneficiary to be?”

#10 Objection – I Don’t Like Bank Drafts

You’ll probably hear this a lot since insurance companies require a bank draft. Try this strategy:

“…Can you pay several months in advance? If you can get the check paid today with a quarterly or greater payment, then take it.”

If they can’t, then I would do this:

“Well, unfortunately, all of these companies require bank drafts. And, there’s nothing I can do to help you with that. Companies no longer send out letters anymore for monthly payments.

But, we can set up a payment schedule after you get paid. That way, you’ll never be charged when you don’t have the money. Can we move forward with that?”

Deal with those 10 common sales objections and close more deals

And that concludes how my agents and I tackle these common insurance sales objections. I hope you’ve gained something from reading this article and will ultimately be able to increase your sales and help more people.

Thanks for reading!

FAQ

What are the top 4 sales objections?

The top four sales objections often include price objections, budget objections, value proposition doubts, and objections about the need for the product or service.

What are the 5 most common customer objections?

The five most common sales objections are price, lack of need, lack of urgency, lack of trust, and preference for another product or service.

What is a sales objection?

A sales objection is a prospect’s concern or hesitation during the buying process that can potentially prevent a sale unless effectively addressed.

What are the 7 methods for handling objections?

Seven methods for handling sales objections include listening carefully, understanding the pain points, reaffirming the value proposition, customizing responses, using social proof, addressing concerns directly, and confirming satisfaction.

What are the 4 handling objections?

The four key techniques for objection handling are: acknowledge, assess, respond, and confirm, ensuring that sales reps address each prospect’s concerns effectively and thoroughly.

What is the biggest objection in sales?

The biggest objection in sales is often the price objection, where prospects feel the cost of the product or service doesn’t match the perceived value.

What is the most common objection in sales?

The most common sales objection typically revolves around budget constraints, with prospects feeling that the price exceeds their current financial capacity.

How to overcome ‘no’ in sales?

To overcome objections and “no” in sales calls, sales reps should focus on reinforcing the value proposition, addressing specific pain points, and understanding the underlying reasons behind the objection to tailor their solutions effectively.

READ ALSO

A Pain of Cold Emailing in Finance and Real Estate: How to Get Through SPAM Filters?

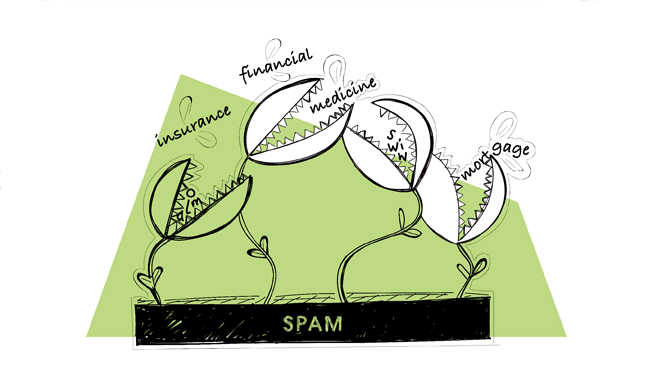

What differentiates cold emailing from other types of 1-to-1 outbound practices is that a huge chunk of a cold emailing process can be automated. You just come up with an email copy, insert a few snippets, add your prospects, and there you have it. A campaign is ready to be sent. You don’t need to send it manually. Still, outreach by email may quickly backfire when you riddle your copy with words that trigger SPAM filters. Words such as ‘insurance’, ‘financial’, ‘medicine’, ‘mortgage’ all alarm SPAM filters. But what if that is the vocabulary you use in your profession on a daily basis? How to avoid going to SPAM then?

How to Qualify Your New Sales Leads? 5 Signs that a Lead Isn’t the Right Fit

Not all of your sales leads are equal in terms of quality. Even when it seems that at first glance they match your Ideal Customer Profile. In this article, you’ll learn how to qualify new sales leads from the moment you first reached out to them all the way through to your first call or demo. With this information at hand, you’ll be able to spot which leads aren’t a good fit for your product and whether you should still pursue them or rather shift your focus to more promising contacts.

10 Reasons Why Your Cold Emails Are Getting No Response

This week we have a guest post by Nina Cvijovic, who is a researcher and writer at Etools. Nina analyzed 10 reasons why your outbound email campaigns may not be reaching the response rate you expect them to, or are not generating any responses at all. Either way, there's always a field for improvement in cold emailing. So go through the 10 checkpoints below, and read some advice on how your response rates can be improved.